Municipals were little changed Tuesday, ignoring another rise in U.S. Treasuries and a weaker stock market, with the focus on the primary which saw deals bumped in repricings.

Another day of UST weakness after less-than-stellar auctions and municipals stayed in their own lane. Some participants said without the UST rise in yields, municipal benchmarks likely would have kept up with their strength.

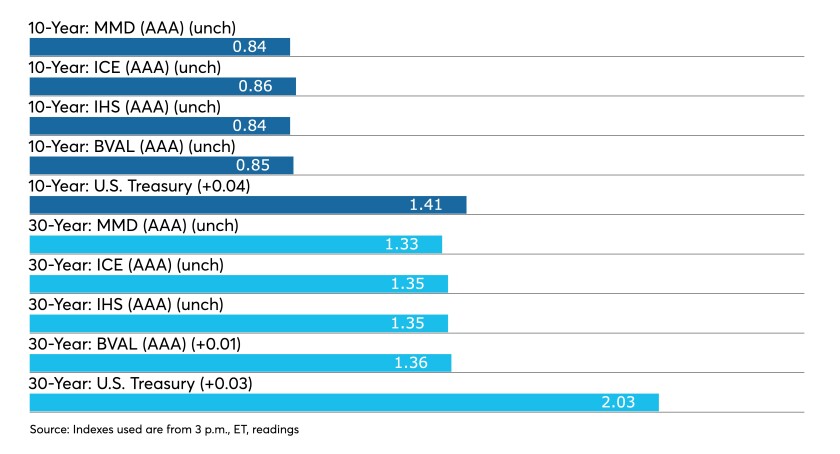

Municipal-to-UST ratios fell Tuesday as UST rose with the 10-year dipping below 60%. The 10-year was at 59% and 65% in 30, according to Refinitiv MMD. ICE Data Services had the 10-year muni-to-Treasury ratio at 61% and the 30-year at 66%.

The primary began pricing to solid investor demand. Triple-A competitive loans from California and Virginia issuers saw levels through triple-A benchmark yields while various negotiated loans saw bumps in repricings.

BofA Securities priced and repriced for the Dormitory Authority of the State of New York $250 million of exempt and taxable New York University revenue bonds with bumps of three to nine basis points. The $212.79 million of exempts saw 5s of 2028 at 0.66% (-3), 5s of 2031 at 0.88% (-9), 5s of 2036 at 1.16% (-5), 3s of 2041 at 1.72% (-3), 4s of 2046 at 1.57% (-6), 5s of 2041 at 1.50% (-3) and 2.25s of 2051 at 2.23% (-2). The taxables, $37.2 million, saw bonds in 2022 yield 0.25% at par (-10), 2026 at 1.18% at par (-5) and 2031s at 2.02% at par.

Wells Fargo Securities priced and repriced for the JEA, Florida, (Aa3/AA+/AA/) $128.765 million of water and sewer system revenue refunding bonds with bumps of three to seven basis points. Bonds in 2023 with a 5% coupon yield 0.13% (-5), 5s of 2026 at 0.45% (-7), 5s of 2031 at 0.97% (-7), 4s of 2036 at 1.36% (-3) and 3s of 2041 at 1.77%.

Citigroup Global Markets Inc. priced for Grand Rapids, Michigan, (Aa2/AA//) $102 million of taxable sanitary sewer system revenue refunding bonds at par with 2022s at 0.125%, 2026s at 0.875%, 2031s at 1.625%, 2035s at 1.625%, and 2041s at 1.875%.

Goldman Sachs & Co. LLC priced for the Rector and Visitors of the University of Virginia (Aaa/AAA/AAA/) $100 million of general revenue pledge bonds. Bonds in 2051 priced at par at 2.20%.

In the competitive market, Orange County Sanitation District, California, (Aaa/AAA/AAA/) sold $135.5 million of wastewater refunding obligation bonds to Morgan Stanley & Co. LLC. Bonds in 2022 with a 5% coupon yield 0.05%, 5s of 2026 at 0.31%, 5s of 2031 at 0.75% and 5s of 2036 at 0.94%.

Fairfax County, Virginia, Water Authority (/AAA/AAA/) sold $83 million of revenue bonds to Wells Fargo Securities with 5s of 2022 at 0.07%, 5s of 2026 at 0.40%, 5s of 2031 at 0.87%, 4s of 2036 at 1.14%, 4s of 2041 at 1.30%, 4s of 2046 at 1.46% and 5s of 2051 at 1.55%.

Institutions on Wednesday will see $580 million of New York City Transitional Finance Authority (Aa3/AA/AA/) building aid revenue refunding bonds, Fiscal 2022 Series S-1, Subseries S-1A after a two-day retail offering.

The uptick in supply ($11.75 billion 30-day visible per Bond Buyer data) is leading BlackRock to anticipate a return to more traditional seasonal trends in the months ahead, with the firm expecting the market will benefit from a favorable supply-demand imbalance into the fall.

“We foresee continued improvement in credit fundamentals due to a combination of fiscal stimulus and the re-opening of the economy, which could lead to rating upgrades,” according to BlackRock. “Additionally, we think infrastructure negotiations will keep the asset class in focus, and the market will likely play a pivotal role in financing new projects.”

BlackRock maintains a neutral stance on duration (interest rate risk) within a barbell yield curve strategy.

“We continue to hold a preference for lower-rated credits and sectors that have been more impacted by the pandemic, such as transportation, education, travel-related (hotel tax, airport, etc.), and healthcare,” they wrote.

Muni CUSIP requests rise again

Monthly municipal volume increased for a fifth straight month in June. For muni bonds specifically, there was a 3.1% increase in request volumes month-over-month and a 13.4% increase on a year-over-year basis with the aggregate total of all municipal securities — including municipal bonds, long-term and short-term notes, and commercial paper — rising 14.3% in June versus May totals.

On an annualized basis, municipal CUSIP identifier request volumes were up 7.2% through June.

“Municipalities continue to issue new debt offerings at a rapid clip, especially during the peak short-term notes season, suggesting opportunistic capital raising in a largely favorable rate environment,” said Gerard Faulkner, direct of operations for CUSIP Global Services.

CUSIP identifier requests, meanwhile, declined 3.3% in June from May. The monthly decrease was driven largely by U.S. corporate debt identifier requests, which declined by 5.7%. On a year-over-year basis, corporate CUSIP requests were down 6.4%.

“The recent slowdown in corporate activity has been notable, however, and will be important to watch over the course of the coming months.”

Secondary trading and scales

Trading was light but showed some slightly firmer prints, or at least at levels from Monday and Friday.

California 5s of 2022 traded at 0.10%-0.09%. San Antonio, Texas, 5s of 2022 at 0.09%-0.08%. New York City 4s of 2022 at 0.10%-0.09%.

New York MTA 5s of 2025 at 0.45% versus 0.47% Monday.

Wisconsin 5s of 2028 at 0.61%-0.60% versus 0.61% Monday. New York Dormitory Authority sales tax bond 5s of 2028 at 0.59%-0.58%.

Georgia 5s of 2033 at 0.94%-0.92% versus 0.94% Monday and 0.93% Friday.

Arlington County, Virginia, 5s of 2035 at 1.00% versus 1.09%-1.08% Wednesday. New York City 5s of 2036 at 1.29%.

Los Angeles MTA 5s of 2039 at 1.09% and 5s of 2040 at 1.12%. Los Angeles Department of Water and Sewer 5s of 2040 at 1.17% and 5s of 2041 at 1.21%-1.20% versus 1.29%-1.28% Wednesday.

Howard County, Maryland, 3s of 2049 at 1.83%-1.82% versus 1.84% Thursday.

Triborough Bridge and Tunnel Authority 5s of 2051 at 1.49%.

According to Refinitiv MMD, short yields were steady at 0.08% in 2022 and 0.12% in 2023. The yield on the 10-year sat at 0.84% while the yield on the 30-year was steady at 1.33%.

The ICE municipal yield curve showed bonds steady at 0.08% in 2022 and to 0.12% in 2023. The 10-year maturity held at 0.87% and the 30-year yield at 1.35%.

The IHS Markit municipal analytics curve showed short yields at 0.07% and 0.10% in 2022 and 2023, respectively, with the 10-year steady at 0.84%, and the 30-year yield also unmoved at 1.35%.

Bloomberg BVAL saw short yields at 0.10% and 0.12% while the 10-year was at 0.85% and the 30-year rose one basis point to 1.36%.

Treasuries were weaker and equities lost ground. The 10-year Treasury was yielding 1.41% and the 30-year Treasury was yielding 2.03% near the close. The Dow Jones Industrial Average fell 106 points or 0.30%, the S&P 500 was down 0.34% while the Nasdaq lost 0.28%.

Inflation looking less transitory

Congress will undoubtedly ramp up its questions for Federal Reserve Chair Jerome Powell about inflation and supporting the economy when he testifies on Wednesday and Thursday.

“This morning’s data just made Jerome Powell’s week much more difficult,” Matt Weller, global head of market research at the StoneX Retail Division of Forex.com, said Tuesday. The argument that inflation will be transitory, “while technically … could still be right, it doesn’t mean this week’s testimony to an uneasy Congress will be any easier.”

“The ‘inflation is transitory’ argument is starting to wobble,” agreed Greg McBride, senior vice president and chief financial analyst at Bankrate.

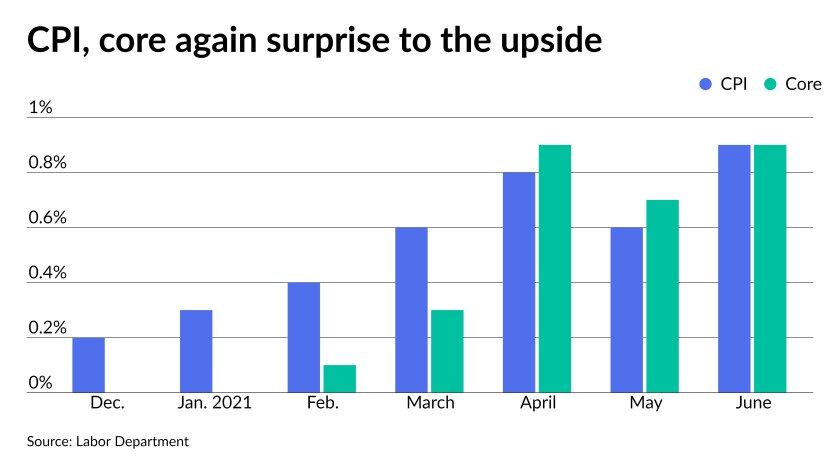

The consumer price index soared a seasonally adjusted 0.9% in June after rising 0.6% in May, while the core rate also jumped 0.9% after a 0.7% gain in May. The headline number increase was the largest since a 1.0% climb in June 2008.

Economists surveyed by IFR Markets had estimated CPI to rise 0.5% and the core to climb 0.4%.

On a year-over-year basis, the CPI was up 5.4%, its biggest 12-month increase since a 5.4% rise in August 2008. The core grew 4.5% on a year-over-year basis, the largest 12-month climb since Nov. 1991.

Economists anticipated an annual increase of 4.9% in CPI and 4.0% in core for the year.

Inflation is definitely trending higher, Bankrate’s McBride said. If you compare these numbers to 2019, to avoid the COVID impact, “CPI is up at a 3% annualized pace over the past two years -that’s up from 2.55% last month.”

Supply chain issues and pent-up demand are “more evident than ever,” he said, and base-effects “won’t wash out for another couple of months.”

Once again used car and truck prices surged, “and this alone was responsible for more than one-third of the increase in CPI,” he said. “We can continue to look at the increases in used car prices, rental prices for cars and trucks, and even airfare and dismiss them as unsustainable — but they’ve sustained for several months already,” McBride said.

“The debate about temporary or problematic inflation will continue for months and will grow more heated,” he said.

Berenberg chief economist for the U.S., Americas and Asia Mickey Levy, said, “The Fed may continue to argue that this spike is temporary, but inflation has risen far beyond its forecasts and the price increases are clobbering consumers’ wallets.”

If, as expected, “strong nominal spending growth persists after the current spurt as the economy reopens, then inflation pressure will also persist, reflecting higher production costs and business flexibility to raise consumer product prices,” he added. “Fueled by tons of pent-up demand and consumer purchasing power, it is starting to look more and more like a stylized cyclical inflation driven by excessive monetary and fiscal ease.”

Aleksandar Tomic, Associate Dean for Strategy at Boston College, said the pressures are not “letting up.”

“At this point, saying that this effect is transitory is likely more wishful thinking than reality,” he said.

Separately, the National Federation of Independent Business’ small business optimism index climbed 102.5 in June from 99.6 in May.

The net percent of owners who raised average selling prices increased to 47%, its highest read since January 1981.

“More small business owners expect business conditions to worsen over the next six months than expect it to improve, and the proportion of firms that expect their earnings to drop over next six months is still larger than the proportion that expect their earnings to improve,” noted Mark Vitner, senior economist at Wells Fargo Securities.

Also released on Tuesday, the U.S. budget deficit grew to $174.2 billion in June from $132.0 billion in May. Last June, the deficit was $864.1 billion. A delayed tax deadline skewed last years’ numbers.

Economists predicted a deficit of $202.0 billion. The deficit year-to-date now stands at $2.2 trillion, down from $2.7 trillion at the same point last year.

Primary market to come

The Rector and Visitors of the University of Virginia (Aaa/AAA/AAA/) is set to price on Wednesday $300 million of taxable general revenue pledge refunding bonds, term 2051. Barclays Capital Inc.

Ohio (Aa2/AA//) is set to price on Wednesday $270.4 million of Cleveland Clinic Health System Obligated Group hospital revenue Series 2021A bonds $69.445 million, serials 2047-2049 and $201 million of forward delivery hospital revenue refunding bonds, serials 2023-2039. Barclays Capital Inc.

The Florida Development Finance Corp. (A2///) is set to price on Thursday $221.2 million of Lakeland Regional Health Systems healthcare facilities revenue refunding bonds. J.P. Morgan Securities LLC.

The Central Florida Expressway Authority (A1/A+/A+/) is set to price on Thursday $200.9 million of senior-lien revenue bonds, serials 2026-2035, Series 2021D. RBC Capital Markets.

The Michigan Finance Authority (/AAA//) is set to price $198.75 million of taxable student loan asset-backed notes, Series 2021-1, consisting of $60 million of fixed rate and $138.75 million of floating rate. BofA Securities.

The Maryland Department of Transportation (A1//A/) is set to price on Wednesday $195.4 million of special transportation project revenue bonds (Baltimore/Washington International Thurgood Marshall Airport), Series 2021B (qualified airport bonds-AMT), serials 2026-2041, terms 2046, 2051. Citigroup Global Markets Inc.

The City of Clarksville, Tennessee, (Aa2//AA/) is set to price $180.84 million of water, sewer & gas revenue bonds, Series 2021A. Morgan Stanley & Co. LLC.

Charlotte, North Carolina, (Aa2/AA+/AA+/) on Wednesday is set to price $164.1 million of refunding certificates of participation transit projects, Series 2021A. Goldman Sachs & Co. LLC.

The Catholic Bishop of Chicago (Ba1///) is set to price $150 million of Series 2021 senior bonds, term 2041. PNC Capital Markets LLC.

The South Dakota Housing Development Authority (Aaa/AAA//) is set to price on Wednesday $139.285 million of homeownership mortgage bonds, $119.285 million of non-AMT Series 2021 B, serials 2021-2033, and terms 2036, 2041, 2051 and $20 million of Series C taxable refunding bonds, serials 2022-2030. Wells Fargo Securities.

Westmoreland County, Pennsylvania, is set to price on Wednesday $126.48 million of taxable general obligation bonds, serials 2021-2041. Boenning & Scattergood, Inc.

The New York State Bridge Authority (Aa3/A+//) is set to price on Wednesday $112.95 million of general revenue and general revenue refunding forward-delivery bonds, $76.475 million of series A, serials 2028-2041, terms 2046, 2051, $36.48 million of Series B, 2022-2036. RBC Capital Markets.

Oberlin College, Ohio, (Aa3/AA-//) is set to price $110.59 million of bonds, $80.65 million of green taxable bonds (Climate Bond Certified) and $29.94 million of corporate CUSIP bonds. Morgan Stanley & Co. LLC.

The Wisconsin Health and Educational Facilities Authority (/AA-/AA-/) is set to price on Wednesday $104.9 million of Gundersen Health System refunding revenue bonds. BofA Securities.

San Antonio, Texas, Education Facilities Corp. (Baa1///) is set to price $100.3 million of higher education revenue improvement and refunding bonds (University of the Incarnate Word Project), Series 2021A, serials 2038-2054. Raymond James & Associates, Inc.

In the competitive market Wednesday, Santa Clara County, California, (/AAA/AA+/) is set to sell $350 million of taxable general obligation bonds at 10:30 a.m.

The New York City Transitional Finance Authority is set to sell $210.3 million of taxable building aid revenue bonds at 10:15 a.m.

San Jose, California, (Aa1/AA+/AAA/) is set to sell $200 million of general obligation bonds at 10:30 a.m.

New Hampshire is set to sell $123 million of Series 2021 C exempt at 10:30 a.m. and $10.2 million of taxable bonds at 11 a.m.

On Thursday, Memphis, Tennessee, is set to sell $160 million of general improvement refunding bonds at 10:30 a.m.